Eernie here, ready to bring you the latest and greatest from the crypto and NFT world. Buckle up, because we're about to dive into the three most important graphs in crypto and NFT. 📊

The case of NFT Blue Chips

First up, we have the NFT blue chips. These are the crème de la crème, the top dogs, the big kahunas of the NFT world. We're talking Bored Apes, Azuki, Doodles, and more. But recently, they've been more like Bored Bears, Azuki Avalanche, and Doodles Downfall. The graph above shows their price in ethereum.

Their floor price makes a nice analogy of a limbo dancer as you can see in the graph above and many NFT collections are cheaper than they have been in years. Bored Apes has dropped a whopping 88 % since April 2022, and Azuki has dropped 59 % in the past week alone.

So, what's the deal? In a word – liquidations. Last weekend we saw a staggering 1,200 liquidations in NFT loans. These are investors who used NFTs as collateral for loans. By comparison, 10-15 liquidations a day is normal. So it's like a Black Friday sale on steroids. And to make it all a little worse, there are hardly any new buyers, only the same old NFT collectors and investors. In a world driven by growth and new growth, this means that it will probably continue to be a bumpy ride in NFT country for a while longer.

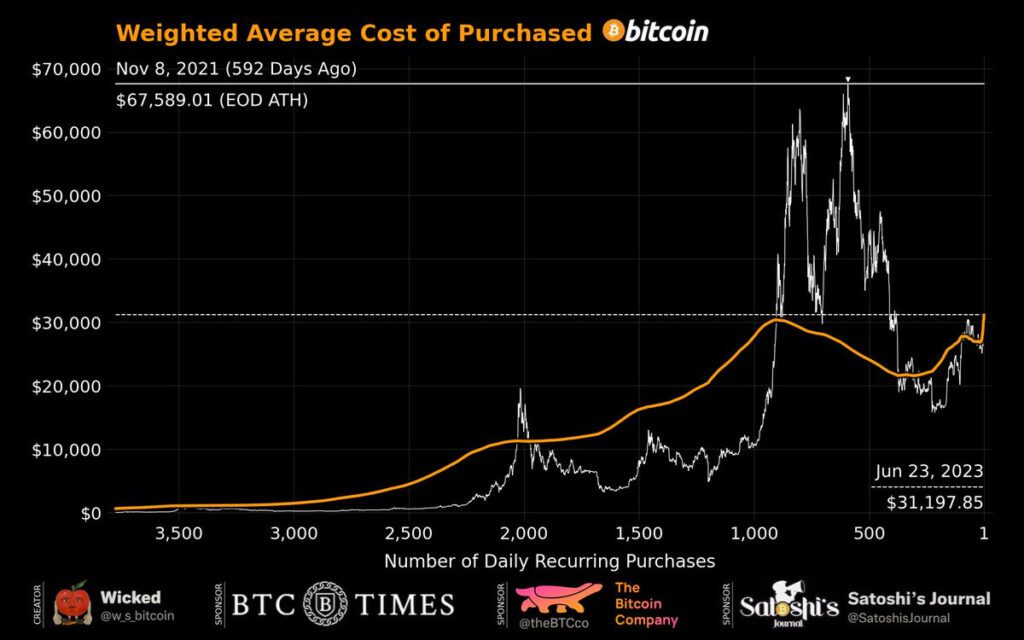

Bitcoin DCA'ers: Living the Green Dream

On a brighter note, let's talk about the Bitcoin-only DCA'ers. DCA, orDollar Cost Average", is when you invest a fixed amount of money into an asset at set time intervals. It's like a subscription service, but for Bitcoin. And guess what? These folks are officially in the green zone.

Some investors have been dabbling in Bitcoin every day for the past few years and now all the daily Bitcoin DCA'ers are in the green. More investors taking profits always leads to more bullish sentiment in the market. So hats off to Bitcoin DCA'ers!

Crypto Inflows: Back-to-Back Wins

Finally, we have some exciting news from the latest crypto fund report. We see $125 million in inflows, marking the second consecutive week of weekly inflows, totaling $334 juicy million.

In the words of the great philosopher Drake, we go "Back-to-Back". Institutional investors are hungry for this crypto exposure. BlackRock has started a Bitcoin ETF craze, and now everyone wants a piece of the delicious crypto pie.

So, when's the Bitcoin ETF? BlackRock and others have refiled their applications this week, hoping to get that coveted SEC green light. Cathie Woods’ ARK SEC date is set for August, so we'll know more then. Until that time, we'll be sitting back, sipping our Dunkin' Donuts coffee, and enjoying this inflow streak.

That's all for now, folks. Stay tuned for more updates from the wild world of crypto and NFTs. Remember, in this space, the only constant is change. And coffee. Always coffee. ☕️